Finances and health dictating retirement plans

By Adam Freill

Construction LabourMajority of people planning to retire would continue working longer if they could reduce their hours and stress.

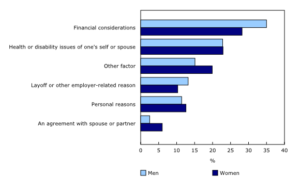

More than one-third of men cite financial readiness as the main factor in determining timing of retirement. (Source: Statistics Canada, Labour Force Survey Supplement (3701), custom tabulation.)

Among those who reported being completely retired, over one-third of men and more than one-quarter of women cited financial reasons as the main factor in determining the timing of their retirement, according to data compiled by Statistics Canada for its June Labour Force Survey. People in this group reported that the most important factor was either that they were financially ready, they had qualified for a pension, or had deferred the start of their Old Age Security pension in exchange for a larger amount.

Health was another top consideration in determining the timing of retirement, which indicates that some people had stopped working earlier than they would have otherwise chosen. Close to one-quarter of those who were completely retired cited issues related to health or disability, either their own or their spouse’s, as the main factor.

The report explains that as the Canadian population ages, the number of retirees increases, which puts downward pressure on labour supply and can lead to shortages of skilled and experienced workers. It may also create challenges for employers, including increased training and recruitment costs. At the same time, increased labour force participation among older workers can help alleviate the impacts of population aging on the labour market.

In June, just over one-fifth of Canadians aged 55 to 59 years reported that they were either completely or partially retired. This proportion doubled to more than two in five for those aged 60 to 64 years, then nearly doubled again to four in five for those aged 65 to 69 years. After the age of 70 years, the proportion of people in retirement reached a plateau, with over 90 per cent of Canadians in that age group reporting they were completely or partially retired.

People retiring for health or disability reasons were more likely to have stopped working at a younger age. Among men in this group, the average age at retirement was 58.5 years, almost four years younger than those who reported financial considerations as the main factor (61.7 years).

Similar observations can be made for women. Among those who cited health reasons as the main factor in determining the timing of their retirement, the average age at retirement was 56.9 years, compared with 60.1 years for those who reported financial considerations as the main factor.

As the population continues to age, employers may want to develop incentives to retain experienced workers, suggests Statistics Canada, adding that some seniors may choose to work longer if they could reduce their hours and their stress.

Among people who had not completely retired but were planning to retire, more than half reported that they would continue working longer if they could work part-time, and about half reported that they would continue working if they could work fewer hours without affecting their pension.

Others said they would continue working if it were less stressful or physically demanding (43 per cent) or if they had the opportunity to do more interesting work (37.6 per cent). A further 34.2 per cent cited pay or salary increases as motivation to continue working, and 29.3 per cent would continue working if their health improved.