Toronto continues to lead Crane Index

By Adam Freill

Commercial Construction Industrial Institutional ResidentialDespite net decrease due to high project completion rate, Canada continues to lead in the Rider Levett Bucknall crane count.

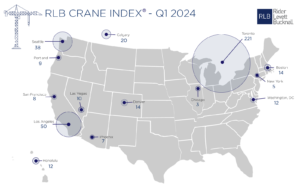

Costs for Canadian construction projects are up significantly over last year, and Canada continues to place at the top of the Rider Levett Bucknall (RLB) Crane Index. Those were some of the key findings as the international property and construction consultancy firm released its latest Crane Index and quarterly Construction Cost Report (QCR). The two documents provide an eye-opening perspective on the North American construction industry in 14 key markets, including Toronto and Calgary.

The latest RLB quarterly Construction Cost Report (QCR), with data from mid-Q1 2024, shows that the national average increase in construction costs in U.S. cities surveyed was 1.29 per cent, similar to pre-pandemic levels. Looking at the data for Canadian cities, as of January, year-over-year construction costs rose roughly six per cent in Calgary and eight per cent in Toronto.

According to the report, Alberta’s economy has experienced steady growth, driven by the oil and gas sector, increased exports to the U.S. and a focus on green energy. Residential building construction investment is on the rise despite higher borrowing costs. In Ontario, the ICI sector posted growth greater than 13 per cent in Q4 2023 and the provincial government has committed to constructing 1.5 million new homes over a 10-year period. January 2024 marked the second-highest number of housing starts in the province since 1990.

“After the past few years of economic uncertainty, I am cautiously optimistic about the construction industry in 2024,” stated Paul Brussow, president of RLB North America. “Despite having reached extremely high peaks, prices for construction materials are finally on a downward trajectory. While the growth of privately funded projects may be soft, public funding for manufacturing and infrastructure projects will help drive industry growth.”

Turning to the Crane Index, Toronto found itself atop RLB’s report once again, with 221 cranes in use in the Greater Toronto Area. That was a drop of 19, but the figures are considered to be flat as the dip was only eight per cent. Calgary, on the other hand, was on the rise, with 20 cranes in use in the city, most of which are most of the city’s cranes are being used for residential projects. Labour availability remains a concern in the region, and is seen as potentially limiting the number of projects that can be underway at a given time in the city. Despite this challenge, housing starts are at record heights.

Both reports can be downloaded from the Rider Levett Bucknall website. The QCR report is available here, and the Crane Index is available here.