Making your project bankable

By David Bowcott

Construction Financing Risk ManagementThe use of risk management strategies and insurance can help projects move forward.

Project owners and construction contractors looking to see shovels hit ground need to work closely together to find ways to make their projects stand out, for the right reasons, to those who supply financial capital.

The interest rate environment is at its highest point in years, and this is seeing some projects being cancelled or delayed. A meaningful way project stakeholders can improve project finance terms is through the use of sound risk management strategies and insurance solutions, since these can help satisfy any growing concerns of their debt partners.

Lenders base their pricing on the perceived risk of the endeavour into which they are deploying capital. In the days of low interest rates, the floor cost for debt was so low that project stakeholders didn’t have to expend too much effort communicating their risk management strategies. The risk premium charged didn’t have as much impact on the project’s financial model. With today’s much higher floor cost for debt, project stakeholders should be digging deeper into their project risk management narrative to not only curb growing financing costs, but, in some cases, to make their project bankable/feasible.

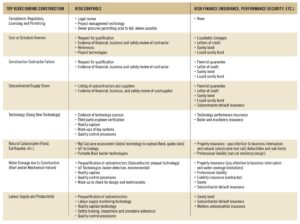

Table 1 illustrates the kind of framework project stakeholders can use to improve their project risk management narrative, to bat down any risk concerns their debt partners may have.

This table is only a sample chart, and is by no means an exhaustive list of construction phase risks and associated risk controls and risk finance solutions. In addition to construction phase risks, there are several operations phase risks that lenders will need to assess for adequacy of risk controls and risk finance solutions, with respect to the project being built.

This table is only a sample chart, and is by no means an exhaustive list of construction phase risks and associated risk controls and risk finance solutions. In addition to construction phase risks, there are several operations phase risks that lenders will need to assess for adequacy of risk controls and risk finance solutions, with respect to the project being built.

Key areas of focus for manufacturing facilities, for example, may include: i) supply of inputs; ii) supply chain disruptions; iii) technology and equipment failure; iv) demand for product manufactured; v) quality control and product liability; vi) energy costs and availability; vii) political and economic instability; viii) natural catastrophe risk; ix) environmental risks; and x) safety and health of labour; to name a few. For each, a similar assessment of risk controls and risk finance solutions should be done.

Ultimately a project risk management assessment framework, if properly executed, should be effective at showing sources of capital that you have consider all potential threats and are using the latest and most effective risk control and risk finance solutions to eliminate or minimize the risk of non-payment – your capital partners do expect to see a return on their investment, after all.

In a time of tight credit, driven by higher interest rates, it becomes imperative to have a very strong risk management plan for all phases of your project’s (or asset’s) life.

David Bowcott is the managing director, construction, at NFP Corp. Please send comments to editor@on-sitemag.com.