Canadian construction activity expected to grow

By Adam Freill

ConstructionSupply chain and labour remain concerns in Q4 survey.

Strong levels of construction activity are expected to continue in Canada in 2022, despite mounting concerns around sourcing materials and labour, says the latest RICS/Canadian Institute of Quantity Surveyors (CIQS) Construction Monitor.

Looking at research gathered in the final quarter of 2021, 40 per cent of construction experts who responded to the survey said they continue to see increases in demand for construction work. That is a small dip from the 46 per cent in the previous quarter, but new infrastructure projects have the industry optimistic.

Infrastructure is seen to be behind much of the increase in workloads, with a net balance of 48 per cent reporting growth in that area. Private housing development continues to show solid momentum as well, with a net balance of 45 per cent of respondents reporting growth in that area.

Looking to the year ahead, infrastructure works are viewed as likely to lead the sector by some 63 per cent of respondents, with private residential and non-residential works both anticipated to also deliver strong growth in output, stated about half of respondents.

New business enquiries held firm in the final quarter, which is consistent with a more upbeat outlook for activity over the next 12 months.

Profit levels may not match the increase in workloads, however. While one per cent of respondents in Q4 anticipate profit margins to increase over the course of 2022, this is down from the six per cent reported in the last survey.

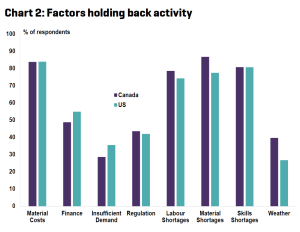

Chief concerns included the availability of materials and how much they cost, suggesting material supply chain issues are continuing to play a significant factor in holding back the Canadian construction sector. A lack of skilled professionals is also contributing to concerns, with 81 per cent of companies saying they are experiencing a shortage. In terms of costs, material prices are expected to soar by nine per cent over the next year. Labour costs are anticipated to rise slightly more than six per cent.

“Predictably, infrastructure is viewed as likely to play a particularly important role in driving workloads reflecting the initiatives taken by administrations on both sides of the border in response to Covid pandemic,” stated Simon Rubinsohn, RICS’ chief economist. “Unsurprisingly, there are significant concerns around the cost and availability of key building materials as well as the requisite skilled labour to meet these ambitious plans.”