Looking forward at construction labour

By BuildForce Canada

Construction LabourBuildForce Canada’s Assessment of Construction Labour Markets from 2023 to 2032.

Construction is one of Canada’s largest industrial sectors. In 2022, total construction industry employment exceeded 1.5 million Canadians, or approximately one of every 13 working Canadians. As a whole, the industry accounts for seven per cent of Canada’s GDP. It is made up mostly of small businesses, with approximately 60 per cent of industry firms classified as micro businesses consisting of fewer than five employees.

As with many sectors of the economy, the construction industry has emerged from the COVID-19 pandemic in a strong position, but with the additional challenge of recruiting from a shrinking labour force.

Labour Force Survey data from Statistics Canada shows employment grew by 101,400 workers (seven per cent) in 2022, while the labour force grew by 85,200 workers (5.5 per cent). The inability of the labour force to grow as quickly as employment helped to bring the construction industry’s average unemployment rate down from six per cent in 2021 to 4.7 per cent in 2022. The national construction unemployment rate reached a low of 2.4 per cent in July 2022, its lowest-recorded rate since 1976.

Total construction industry employment increased in 2022 on the strength of elevated investment levels in new-home construction, public-sector institutional buildings, and public-transit systems. This rapid rise in construction demands created tighter labour market conditions throughout most of the year.

Provinces such as Ontario, British Columbia, Quebec, Nova Scotia, and Prince Edward Island were particularly impacted, as investment levels were high in both residential and non-residential segments.

These additional construction demands created recruitment challenges for many employers, both in the residential and non-residential sectors. Labour market pressures in the residential sector should ease in 2023 and 2024, as the rapid rise in interest rates recorded in 2022 has moderated demands for new homes. Renovation and maintenance demands, however, are expected to grow almost continuously through the forecast period.

In the non-residential sector, labour market demands are unlikely to ease until the middle years of the forecast period, given the high volume of large projects underway in most regions of the country.

National construction forecast overview (2023 TO 2032)

While less impacted than other sectors of the economy, construction continues to recover from the lingering effects of the emergency measures introduced to control the spread of COVID-19. Although temporary, these measures not only impacted industry training, but also forced some older workers to leave the workforce to deal with pandemic-related family obligations. The slow return of these older workers to the labour force contributed to tighter labour markets in 2021 and the early part of 2022.

Strong demand for construction services created market conditions in which employment demands for much of the year outstripped the capacity of the labour force to keep pace with growth, leading to lower overall industry unemployment rates across most of the country.

Construction investment has increased dramatically since the pandemic, with governments at all levels investing heavily in infrastructure as a tool to stimulate the economy. In 2022, combined residential and non-residential construction investment increased by three per cent over 2021’s record high.

Residential investment levels were driven by record-low interest rates in the first half of the year and a growing demand for housing that was spurred by low rental vacancy rates in many cities and high levels of immigration. The non-residential sector benefited from stronger levels of public-sector investment in healthcare, utilities, transportation, and public transit, as well as robust levels of private-sector investment.

Overall investment in the residential sector was up two per cent from 2021 levels, while investment in the non-residential sector added four per cent. BuildForce Canada forecasts construction investment to contract in 2023 and 2024 as higher interest rates cool the country’s strong housing market, and as a number of key non-residential mega-projects conclude.

Total construction investment is poised to contract by four per cent in 2023, with demand reductions of eight per cent in the residential sector and one per cent in the non-residential sector. The contraction is brief, however. By 2032, total investment is expected to grow slightly, up one per cent compared to 2022 levels.

Continued investment growth lifted construction employment in the 34 trades and occupations tracked in the BuildForce Canada LMI model to above 1.16 million workers in 2022, an increase of five per cent compared to 2021. The residential and non-residential sectors both added workers.

As construction investment contracts into 2023, total employment is expected to decline. A loss of four per cent of the residential-sector workforce will more than offset further growth of just above 1.5 per cent in the non-residential sector to create an overall contraction of one per cent.

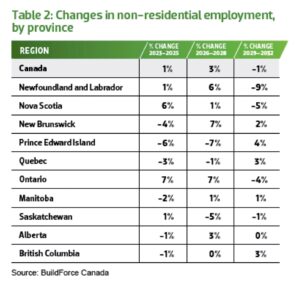

These diverging trends continue into 2024, before growth resumes in both sectors in the medium term and remains mostly unchanged through the long term. By 2032, overall employment is expected to add one per cent, as a gain of four per cent in the non-residential sector more than offsets a loss of one per cent in the residential sector.

Although employment is expected to record only modest increases over the 10-year forecast period, labour force management will be challenging. Industry retirements are expected to reach their highest levels in the near term as large numbers of workers from the baby boomer generation exit the industry.

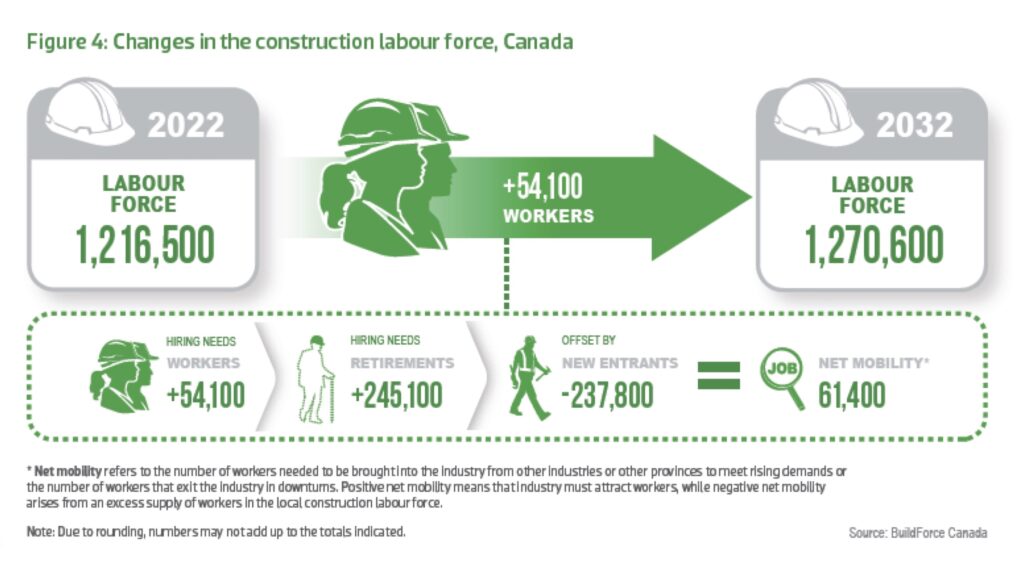

Construction demands will require the industry’s labour force to expand by 54,100 workers over the forecast period. When this demand growth is added to the 245,100 individuals expected to retire during this period – approximately 20 per cent of the 2022 labour force – the overall industry recruitment requirement rises to 299,200 workers by 2032.

Although the industry is expected to recruit approximately 237,800 new-entrant workers under the age of 30 during this period to help offset some of this requirement, even at these heightened levels of recruitment, the industry is likely to be short 61,400 workers by 2032.

Non-residential investment

Since the onset of the pandemic, nonresidential construction investment has been supported by a series of major projects across the industrial, commercial, and institutional (ICI) and engineering-construction sectors. These were deployed as tools to stimulate the economy, and in response to growing population demands.

After rising by almost 10 per cent in 2021, non-residential construction investment increased again in 2022 – by just over four per cent, with both the ICI and engineering-construction sectors growing.

Activity in the engineering-construction sector has grown since 2020 on the strength of major transit, utility, and roads, highways, and bridges projects in Ontario, British Columbia, Quebec, Nova Scotia, and Prince Edward Island. As several of these projects conclude in the near term, investment cycles down. By 2032, engineering investment contracts by eight per cent compared to elevated 2022 levels.

Investment in the ICI sector has been on a steady growth curve since 2017. Levels have increased in every province, supported by major education and healthcare projects, as well as across the commercial and industrial sectors. The outlook for the sector calls for a series of increases across the forecast period, with investment ending the decade 14 per cent above 2022 levels.

Growth is particularly strong in the commercial sector, where investment increases annually to 2032, adding 26 per cent over 2022 levels. Gains in the industrial sector (10 per cent) and the institutional sector (six per cent) are less pronounced.

Non-residential employment

Employment in the non-residential sector added nearly 24,000 workers in 2022, rising by four per cent over 2021 levels. Employment is poised to grow continuously between 2023 and 2027, rising to above pre-pandemic levels and a forecast peak of more than 602,900 workers (five per cent above 2022) by 2027. Growth will be greatest in provinces with strong engineering construction and institutional demands.

Between 2022 and 2026, employment will increase by more than 26,000 workers before declining slightly through most of the remaining forecast years. By 2032, non-residential employment is expected to increase by 21,600 workers – a four per cent rise over 2022 levels.

Note that the widespread conversion of ICI buildings to the greater use of electricity for heating and cooling is excluded from this report, as these efforts are still in their early phases and have had only minor impacts on overall construction labour markets. As these efforts accelerate, they will be added to future BuildForce Canada outlook reports.

Non-residential labour force

Rising demands across the non-residential sector will require the labour force to increase by some 42,100 workers across the forecast period. Over the same period, an estimated 120,800 workers are expected to retire, bringing recruitment requirements to 162,900.

Based on historical trends, and supplemented by the industry’s ongoing career-promotion efforts, an estimated 130,000 workers under the age of 30 are expected to join the non-residential construction sector. However, without additional recruitment efforts, the industry may be short as many as 32,900 workers by 2032.

Addressing peak demands through interprovincial mobility may be challenging. With many provinces reporting higher or sustained levels of construction activity, in the non-residential sector in particular, there may not be strong incentive for workers to relocate.

Competition for workers will be most intense in British Columbia and Ontario, where many major projects are planned and underway, and where labour markets are already tight.

Building a sustainable labour force

Employment growth in 2022 was widespread, though younger workers made up a larger share of employment gains. The increased participation among youth in the industry is a positive signal. Not only does it reverse a decades-old trend of contracting numbers of workers in the sector, but it also suggests that efforts to attract more young people into careers are bearing fruit.

These efforts will be increasingly important over the forecast period, particularly as Canada’s population ages and the youth population declines. These demographic shifts will contribute to tighter labour markets, as labour force participation by older workers is much lower than that of their younger counterparts.

Labour force diversification: Under-represented groups

The share of younger Canadians available to enter the labour force has been in decline for several years. As the baby boomer generation of workers commences retirement over the next decade, the competition for younger workers will be intense.

To mitigate the impact of this demographic shift, the construction industry must diversify its recruitment. The industry must increase recruitment of individuals from groups traditionally under-represented in the current construction labour force, including women, Indigenous People, and newcomers.

In 2022, there were approximately 199,600 women employed in Canada’s construction industry, of which 27 per cent worked on site, directly on construction projects, while the remaining 73 per cent worked off site, primarily in administrative and management-related occupations. Of the 1.16 million on-site tradespeople employed across the 34 trades and occupations tracked by BuildForce Canada, women made up five per cent.

The estimated 53,900 tradeswomen in Canada are represented across all sectors of construction, but given the nature of construction work, women account for a higher share of total tradespeople (five per cent) in residential construction. The top five trades and occupations in which women tend to be employed are trade helpers and labourers (18 per cent of all tradeswomen), construction managers (15 per cent), painters and decorators (14 per cent), contractors and supervisors (eight per cent), and carpenters (seven per cent).

The Indigenous population is the fastest growing population in Canada and therefore also presents recruitment opportunities for Canada’s construction industry. In 2021, Indigenous People accounted for 5.1 per cent of Canada’s construction labour force. This share is notably higher than the share of Indigenous workers represented in the overall labour force. The share of Indigenous People in the labour force across all industries has been growing at a faster pace than construction over the past five years.

Canada’s construction industry may also leverage newcomers (immigrants) over the forecast period to meet labour requirements. Due to the declining natural rates of population growth, immigrants are the primary source of labour force growth in Canada. Immigrants have been playing an increasingly important role in replenishing the workforce, with the share of immigrants in the workforce increasing from 21 per cent in 2011 to 27 per cent in 2021.

Canada has been successful in attracting and integrating immigrants into the labour force; however, immigrants remain under-represented in the construction industry. The construction labour force share of immigrants was 18 per cent in 2021, which is notably lower than the share in the overall labour force.

Conclusions and implications

The 2023–2032 BuildForce Canada Construction and Maintenance Looking Forward forecast sees construction employment continuing to grow as the sector maintains its post-pandemic growth curve. In the short term, growth will be constrained somewhat by a reduction in residential investment created by higher interest rates. Activity in the non-residential sector, meanwhile, remains on a steady upward trend in most provinces. By 2032, overall employment is expected to increase by one per cent from 2022 levels.

Non-residential employment enters the forecast supported by a broad range of major institutional and engineering-construction projects across the country. These include public transit works in Ontario and Quebec; utilities in British Columbia and Ontario; mining in Ontario and Saskatchewan; roads, highways, and bridges in British Columbia, Nova Scotia, Ontario, and Quebec; and healthcare facilities in Nova Scotia, Quebec, Ontario, and British Columbia.

Non-residential employment is anticipated to rise to a peak around 602,900 workers in 2027 (and to above pre-pandemic levels by 2026), before declining modestly through the remainder of the forecast period. By 2032, employment is expected to increase by 21,600 workers – a four per cent rise over 2022 levels.

Meeting peak demands will be challenged by limited provincial mobility. Many provinces are already experiencing high or sustained levels of construction activity, giving workers no strong incentives to relocate in the near term. Labour market challenges are complicated by the retirement of an estimated 245,100 workers, or 20 per cent of the 2022 workforce. This represents a significant loss of skills and experience that is unmatched by new workers.

The task of attracting new workers to construction may become further complicated as other industries face similar challenges related to replacing an aging labour force. Meeting near- and long-term demand requirements will require a combination of industry strategies.

BuildForce Canada is a national, industry-led organization committed to working with the construction industry to provide information and resources to assist with its management of workforce requirements. Its mandate is to provide accurate and timely labour market information to advance the needs of the entire construction industry to develop a highly skilled labour force that will support the future needs of Canada’s construction industry. To access the full construction labour report, please scan the QR Code.

BuildForce Canada is a national, industry-led organization committed to working with the construction industry to provide information and resources to assist with its management of workforce requirements. Its mandate is to provide accurate and timely labour market information to advance the needs of the entire construction industry to develop a highly skilled labour force that will support the future needs of Canada’s construction industry. To access the full construction labour report, please scan the QR Code.