Commercial real estate outlook steady, says Morguard

By Adam Freill

Commercial ResidentialNorth American real estate and property management firm reports a steady Q4 2023 for Canadian commercial real estate market.

(Image courtesy of Morguard: 2023 Canadian Economic Outlook & Market Fundamentals Report Q4 Update.)

The Canadian commercial real estate sector garnered a steady level of interest overall amid economic uncertainties during the fourth quarter of 2023, reports real estate and property management firm Morguard in the company’s 2023 Economic Outlook and Market Fundamentals Fourth Quarter Update.

According to the report, multi-suite residential rental, industrial and retail properties exhibited continued strength and resilience and positive performance momentum. The company says that easing inflation and interest rate pressures will play a role in both the industry and overall economic growth in 2024.

“Industry gains are anticipated once again in 2024, as inflation and interest rate pressures moderate and investment confidence levels build,” said Keith Reading, senior director of research at Morguard. “Canada’s economic performance and the central bank’s projected rate cuts are crucial factors to keep an eye on as the industry forges ahead.”

According to Morguard, the growth cycle for Canadian multi-suite residential rental properties exhibited signs of moderation during the fourth quarter after reaching its peak over the recent past. Rent growth slowed in the nation’s most expensive rental markets, namely Toronto and Vancouver. Contrarily, above-average rent growth was reported in Alberta, which the company say was fueled by increased demand as international and inter-provincial migration surged. Rent growth is expected to moderate over the next several months, in keeping with the recent trend.

Figures in the report show that multi-suite residential rental property transaction volume rose by more than 30 per cent quarter-over-quarter but remained below the long-term average. Nonetheless, the sector managed to attract significant interest due to its positive performance characteristics and long-term track record.

While investment property sales activity in the Canadian commercial property sector continued to slow in the fourth quarter of 2023, industrial property sales increased quarter-over-quarter. Available industrial supply increased slightly over the recent past, due to a combination of a wave of new construction completions and more moderate leasing demand. Leasing demand had outpaced supply over much of the past few years during the peak phase of the cycle following the initial phase of the pandemic.

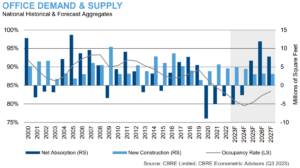

The office leasing market performance was mixed in the fourth quarter, as leasing demand characteristics varied significantly. Generally, class A buildings outperformed class B and C buildings by a significant margin. This mixed trend in the office leasing market is projected to continue in 2024.

Investors demonstrated confidence in the Canadian retail property sector as seen in the sale of separate interests in two prime Greater Toronto Area shopping centres. Confidence was highest for low-risk, high quality retail assets with positive performance characteristics, as shopping behaviour continued to evolve. Investors exercised caution when assessing higher-risk retail asset acquisitions given the high cost of debt capital and increased economic uncertainty.

Looking to economic factors, the Morguard report discussed the cooling of the Canadian economy during the second half of 2023, predicting this to be a trend that will continue through much of the first half of 2024. Consumer spending slowed in the late stages of 2023, as the Bank of Canada’s interest rate hikes reduced the funds available to Canadian households to spend on discretionary items.

The Bank of Canada held off on changes to its policy rate in the fourth quarter considering the slowdown of Canadian economy, consumer spending and labour market growth. By the end of the fourth quarter, it was widely anticipated that the central bank may start cutting rates as early as the spring of 2024 if inflation pressures continue to ease. Despite the near-term softening trend, Canadian consumer spending growth is expected to strengthen in the second half of 2024, driven by lower interest rates, reduced inflation and increased economic activity.

Morguard’s 2023 Canadian Economic Outlook and Market Fundamentals Fourth Quarter Update along with the company’s 2024 Canadian Economic Outlook and Market Fundamentals Report are available at morguard.com/research.