Positive outlook for Canada’s construction industry

By Adam Freill

Commercial Construction Industrial Institutional Labour ResidentialCommodity prices are stabilizing and government investment in energy and industrial sectors is increasing, but risks remain, including inflation and ongoing labour shortage.

The latest commodity report from global construction consultant Linesight paints a picture of encouraging growth as Canada’s Real GDP exceeded expectations and job growth continued in Q1 2023.

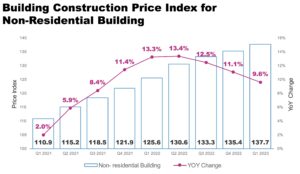

The company’s Q2 Canadian Country Commodity Report acknowledged that a decline in the residential sector contributed to a contraction in the construction industry, but suggested the industrial sector is poised for growth. The company cited the Canadian government’s commitment to establish Canada as an industrial hub, and investments in EVs, green hydrogen, metals and materials processing as growth drivers in the energy and high-tech industrial sectors that will foster growth in the non-residential sector. Warnings were posted, however, about risks due to ongoing inflation, high interest rates, and labour shortages, all of which continue to impact the industry.

“The signs are promising for the Canadian economy overall, but the construction industry faces lingering challenges,” stated Patrick Ryan, Linesight’s executive vice-president for the Americas. “Labour shortages – due to growing demand for healthcare, infrastructure, data centres, and life sciences – are still impacting project delivery and budget. Multiple sectors are expanding in Canada, all of which will put increasing demand on materials.”

He pointed to a pair of major gigafactories scheduled to be built in Southern Ontario, as well as government investments in healthcare, life sciences, and infrastructure, explaining that all of the projects will impact demand for materials and personnel.

Key findings in the report include an expectation for the construction industry to shrink by 5.2 per cent in 2023. This is due to a significant decline in the residential sector, but the news gets better soon. Overall, the construction sector is expected to rebound with 2.7 per cent growth anticipated between 2025 and 2027. This rise, says the report, will be due to investments playing out in the industrial, energy, and transportation sectors.

Helping the construction sector are material prices that have come down from the highs experienced during the pandemic. Lumber prices are stable this year after two years of high volatility; copper prices have dropped 5.5 per cent in Q2 2023 but may be volatile for the next two quarters; and steel rebar prices are down from 2022 highs and likely to continue edging downwards in the months to come. One key construction ingredient, cement, remains elevated in price. According to the report, cement costs have continued to increase due to stricter environmental regulations, but prices are rising at a slower pace than before and an awaited drop in production costs and construction output may help prices decline.

Looking to sector-specific trends, Canada’s data centre sector has experienced remarkable growth, driven by increasing demand for cloud computing, IoT favourable climatic conditions, and a low risk profile. There are currently more than US$7.4 billion-worth of data center projects in the pipeline, with a significant concentration in Ontario and Quebec.

Despite economic challenges, the industrial construction sector has shown positive trends in investments and building permits since the start of 2023. This segment is projected to achieve a growth rate of 15.5 per cent in 2023 as its output is bolstered by investments in electric vehicle markets and the government’s ambition to establish the country as an industrial hub.

To read the full report, click here.