2023 starts flat despite surge in apartments

By Adam Freill

Construction ResidentialApartment construction, particularly in the rental segment, sustained housing starts in Canada's largest cities, reports CMHC in its 2023 Housing Supply Report.

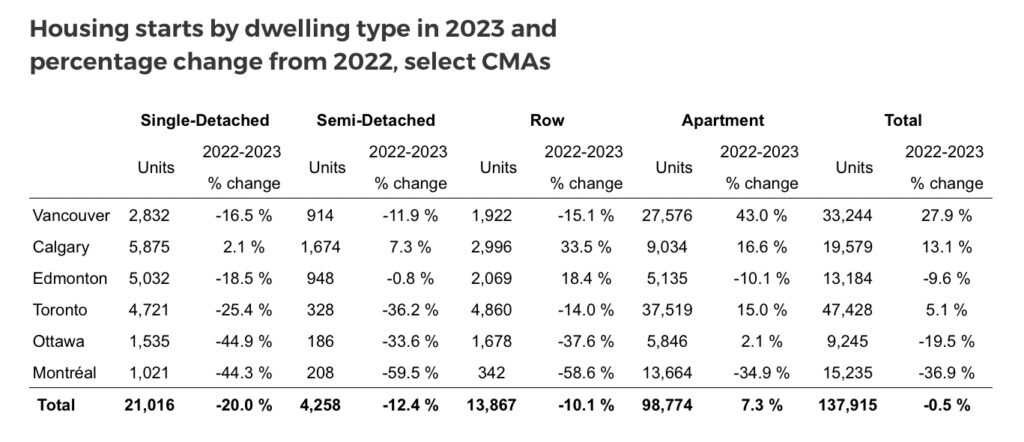

A surge in apartment construction, particularly in Toronto, Vancouver and Calgary, more than offset declines in single-detached and semi-detached construction, causing the overall level of new home construction in Canada’s six largest cities for 2023 to remain virtually unchanged from 2022, reports Canada Mortgage and Housing Corporation (CMHC) in its latest Housing Supply Report (HSR). The report examines new housing construction trends in Canada’s six largest census metropolitan areas (CMAs).

Apartment construction, which includes both purpose-built rental and condominium apartments, reached record levels in Toronto, Vancouver, Calgary and Ottawa. Montréal, however, hit an eight-year low.

Purpose-built rental units accounted for a greater proportion of apartment starts in 2023, compared to historical averages, reflecting an unprecedented level of rental demand says CMHC. The agency explained that record condominium apartment starts reflected robust pre-sale activity and favourable borrowing rates secured prior to 2023.

“There were a large number of housing starts in 2023, particularly in the rental segment, which is good progress, but not enough to improve affordability,” stated Aled ab Iorwerth, deputy chief economist for the CMHC. “The concern now shifts to whether construction of apartments will hold at these high levels in 2024. Clearly the demand for housing exists, particularly in rental, but financing costs could become too heavy for homebuilders to begin construction on large multi-family projects at the same pace seen in 2023.”

“There were a large number of housing starts in 2023, particularly in the rental segment, which is good progress, but not enough to improve affordability,” stated Aled ab Iorwerth, deputy chief economist for the CMHC. “The concern now shifts to whether construction of apartments will hold at these high levels in 2024. Clearly the demand for housing exists, particularly in rental, but financing costs could become too heavy for homebuilders to begin construction on large multi-family projects at the same pace seen in 2023.”

The 2023 Fall Economic Statement announced an additional $15 billion in new loan funding for the Apartment Construction Loan Program (ACLP), the largest program in the federal government’s National Housing Strategy (NHS). That additional funding for the program that provides low-cost loans to eligible purpose-built rental developers is set to start in 2025–2026, and will bring the program’s total to over $40 billion in loan funding, supporting the construction of 101,000 new rental homes by 2031-32.

The HSR also examines supply-side challenges, including high construction and financing costs, the complexity of developing larger projects and labour shortages. Construction timelines for all dwelling types were above historical averages in 2023, reflecting some of these challenges.

The full Housing Supply Report (HSR) is available on the CMHC website.