The total cost of ownership mindset

By David Bowcott

Construction Financing Leadership Risk ManagementIs this the construction industry’s ESG holy grail?

As the world looks to find ways to inject more long-term thinking into our collective decision making, under the banner of Environmental, Social and Governance (ESG), one can’t help but wonder what this change in philosophy will have on the construction industry and the larger built environment.

What will be the construction industry’s holy grail when it comes to contributing to this long-term, more responsible, philosophical movement?

To answer that question, we should look very closely at how the design, construct and operate component parts of the built environment determine value (or perceive value).

In its current state, the built environment stakeholders use a model that calculates value on the isolated cost of design, the isolated cost of construction, and the isolated cost of operations — and short-term operations at that. The cheaper those costs are, the more value we should be delivering for society, right? Not so fast!

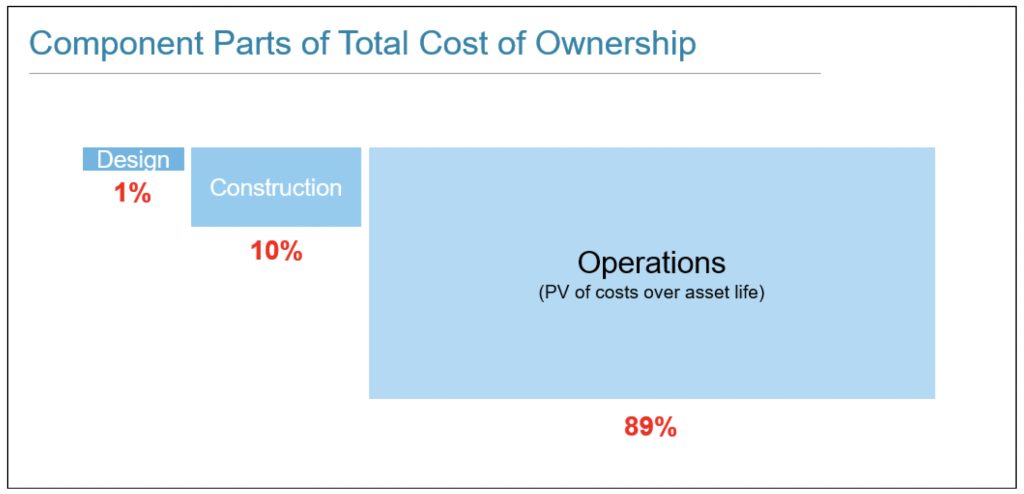

Let’s look at the component parts that make up the total cost of ownership for an asset in the built environment. Yes, these vary from asset to asset, but the figures in the chart below tend to be representative of the breakdown of costs.

Given this breakdown, are current procurement models really delivering optimal total cost of ownership when each cost category of the asset’s life is judged on an individual basis?

Given this breakdown, are current procurement models really delivering optimal total cost of ownership when each cost category of the asset’s life is judged on an individual basis?

Could the construction industry and its primary stakeholders not devise a better way — a more responsible long-term driven way — of creating value, not only for themselves, but for society at large? Many believe the timing is right to completely re-design the procurement models being used to design, build and operate built environment assets.

In the past, it was very difficult to measure total cost over the life of an asset, so asset stakeholders were left judging value on short term cost categories, primarily the design and construction costs. Given advancements in technology and data, through the emergence of the built environment digital twin, we are now entering an age where total built asset costs can be measured. Today, there is potential for procurement to shift from total cost of construction to total cost of ownership.

Under a total cost of ownership procurement model, all the major built asset stakeholders (the owner, the designer, the contractor, and even major subcontractors) would collaborate around design and construction strategies that wouldn’t simply focus on lowering cost of construction. Rather, the focus would be on strategies that would lower the cost of ownership over the entire life of the asset.

Could you design the building to use fewer staff in operations? Could you use more durable materials to reduce refurbishment costs during operations? Could you use methodologies, equipment and materials that lower the carbon footprint of the asset, thus minimizing future tax implications related to carbon?

These, and many other long-term costs, can be considered under such a model.

Through the constant monitoring of the asset’s performance, risks and costs over its entire lifespan, and using digital twin technologies and data, all built-asset stakeholders will be able to measure the total cost of ownership impacts.

Further, as more whole-life digital twin data is captured, one could begin to see a procurement model emerge that will allow stakeholders to see how increases in the design and construction costs could create savings that are multiples of those costs throughout the asset’s operational life.

Imagine having the ability to prove, through technology and data, that a 20 per cent increase in the design and construction costs, or a 2.2 per cent increase in the total cost of ownership, could lead to a 20 per cent reduction in the operating costs of the built asset over the asset’s life. That’s a 17.8 per cent decrease in total cost of ownership. The impact would be game changing.

QUANTIFYING THE POTENTIAL IMPACT

To crystalize the potential impact such a change in procurement could have on society, one need only consider the size of the construction industry, and the overall built environment.

The construction sector designs and builds approximately $13 trillion in built assets each year and the total value of built environment inventories are currently around $250 trillion, and given the growth in the global middle class, that inventory is slated to grow significantly over the next 30 years.

Using the previously referenced breakdown of total cost of ownership, with one per cent going to design; 10 per cent construction; and 89 per cent on operations, the present value of the operational costs of the current built environment asset base is approximately $2 quadrillion, or eight times the design-build costs of $250 trillion.

This gives us a grand total cost of ownership of all built environment assets in the range of $2.25 quadrillion. If we adopted a long-term focused procurement model that proposed a 20 per cent increase in design-build costs, but that could lead to a 20 per cent decrease in present valued operational costs — our 2.2 per cent increase in total cost of ownership that could lead to a 17.8 per cent decrease in total cost of ownership — we could see a net benefit to society over time of 15.8 per cent, or $351 trillion.

With impact levels of that magnitude, there is little wonder why many in the industry are starting to consider the total cost of ownership mindset the construction industry’s holy grail.

David Bowcott is Global Director – Growth, Innovation & Insight, Global Construction and Infrastructure Group at Aon Risk Solutions. Please send comments to editor@ on-sitemag.com.