Construction activity declined 41 per cent at height of pandemic, but quickly regained ground, report says

By On-Site Staff

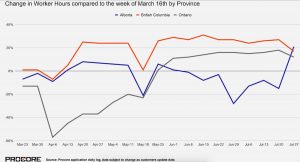

LabourWith a wide range of sites shut down across Ontario and work slowing in British Columbia and Alberta, the week of April 6 saw construction activity hit bottom across the three provinces, with progress dropping 41 per cent from mid-March.

The new figures from construction management software firm Procore, show worker hours sliding precipitously to their pandemic low during the first full week of April. Ontario, which ordered major portions of its construction industry to close April 4, was by far the hardest hit, with hours worked declining 57 per cent. B.C. and Alberta, the other two provinces for which data is available, saw drops of seven and nine per cent, respectively, the week of April 6.

Earlier reports from Statistics Canada also showed the damage COVID-19 wreaked on construction in April. Coast to coast, more than 313,000 workers, or 21.1 per cent of staff, were laid off.

Despite the abrupt decline, the recovery throughout the construction sector has also been relatively quick. The industry has added back tens of thousands of jobs each month since April, numbers from the federal agency show. As of July, the construction labour force stood at 91.6 per cent of its pre-pandemic level.

The latest Construction Activity Index from Procore tells a similar story. Worker hours in Ontario inched back up through April and May, climbing above the baseline week of March 16 by the beginning of June. Job sites bounced back far quicker in B.C. and Alberta, where worker hours had turned positive by the week of April 13.

While activity in B.C. has remained strong during the pandemic, Alberta workers faced declining hours through much of June and July.

Currently, a sense of uncertainty persists throughout the industry, but indicators show optimism is returning. The latest Construction Monitor survey from the Royal Institution of Chartered Surveyors (RICS), for instance, shows the industry is confident the infrastructure segment will drive a recovery in the year ahead, even as expectations for the residential and non-residential building markets remain muted.