Assessing the impact of rising rates

By Adam Freill

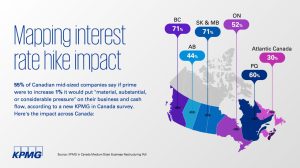

Construction FinancingKPMG poll suggests that Canadian businesses are feeling material pressure on their margins.

Rising interest rates, material and labour costs are eroding profit margins at many Canadian companies and are forcing these companies to re-evaluate their growth plans. Many are passing on these costs to customers.

Those are the findings of recent polling research conducted by KPMG in Canada. Around two-thirds of the C-suite executives polled are also concerned that higher rates around the world will trigger a global economic slowdown.

More than 70 per cent of the mid-sized business owners and decision-makers say higher rates have already put “material pressure” on profit margins and over half are expecting some form of impairment to their business, that is, a loss in value as a result.

Nearly half (45 per cent) say higher rates have derailed their growth and/or investment plans. An equivalent percentage outright said they are putting expansion plans on hold for now because of rising rates and/or the lack of available talent, pointing to the significant cost to the economy from Canada’s tight labour market.

“The headwinds are certainly intensifying, and causing companies to pause or rethink expansion plans,” says Paul van Eyk, partner and national leader of Restructuring and Turnaround Services, Deal Advisory, at KPMG in Canada. “In the wake of the COVID crisis, many companies that were seeking to make up for lost ground are now navigating a number of new risks, including higher interest rates, inflated supply inputs and a tight labour market. However, it’s encouraging to see that many companies are proactively reacting and planning to seek help on ways to minimize the impacts.”

Other findings of the polling include that 54 per cent have reconsidered or put on hold technology-related spending due to rising interest rates and inflation; more than half are slowing any hiring plans for more skilled workers; and many (59%) are talking with lenders about revising loan agreements or covenants.

“When we talk about restructuring, it’s really approaching your best- and worst-case scenarios with a different lens and finding creative solutions to solve them,” says van Eyk. “I always tell my clients, regardless of their size and complexity, ‘Cash is oxygen.’ When looking at your cash flow you need to understand your oxygen level.”

In previous KPMG research, a third of companies surveyed said a two-per cent increase above their current borrowing rates was their tipping point, putting their company at risk, creating significant challenges, or derailing their growth or investment plans.

With the annual rate of inflation hitting 6.8 per cent in April, the highest since 1991, Canadians can expect more price hikes this year.

As companies increasingly look to retain or attract talent, rising labour costs will also likely put more pressure on consumer prices. Nearly 70 per cent of companies surveyed by KPMG say rising salaries have been or will be passed on to their customers.

Wherever possible, companies are also looking to build up their inventories, stockpile and/or lock into supply chain contracts in anticipation of mounting inflationary pressures. Almost 75 per cent are building their inventories, stockpiling and/or locking into supply chain contracts in anticipation of higher inflation wherever possible