2020 Construction Forecast: Positive momentum to continue, but industry needs to embrace change

By David Kennedy

Construction Financing Infrastructure Labour P3s Risk Management Skills Development Software

A long list of major construction projects are underway across the country. Even Parliament is undergoing a major facelift, with a new project at Centre Block described as “the largest, most complex heritage rehabilitation” ever undertaken in Canada. PHOTO: Public Services and Procurement Canada

A steady stream of building projects in most regions of Canada, and particularly within its big urban centres, have kept the construction industry busy through the second half of 2019. Though concerns about how long growth can continue persist, much of the same is forecast for the year ahead, with most industry experts seeing the nationwide outlook for 2020 as positive, or at least steady.

In a country as large and as diverse as Canada, there are exceptions. Certain provinces are expected to just hold their own over the next 12 months, or see slight declines in activity. The continued muted performances of the oil and gas and resource sectors, for instance, mean the Prairie provinces will be getting little help. In Atlantic Canada as well, industry watchers see few catalysts that will propel the building market beyond neutral.

Elsewhere, most see reasons to be optimistic growth will continue. As has been the case in recent years, significant expansion in cities — Montreal, Ottawa, Toronto and Vancouver most notably — will likely lead the way, fuelled by new residential and commercial builds, as well as a laundry list of multibillion-dollar infrastructure projects vital to supporting growing populations.

Related: What are the Top 10 construction trends to focus on in 2020?

The positive sentiment comes with an asterisk. For the most part, the construction industry and its labour force have been able to absorb burgeoning demand across the country over the past several years. In 2020 and beyond, this may begin to change.

As fewer young workers embrace construction and a large cohort of industry veterans step out of their steel toes for good, experts agree that simply maintaining the status quo isn’t an option. Along with changes that will make the industry more welcoming to groups that have traditionally shunned working on job sites, the industry needs to take steps to increase productivity. New technologies, innovative operational processes and methods that force stakeholders to take a more collaborative approach to projects all have a role to play in Canada’s construction industry recalibrating itself to meet the demands of the modern world.

ACROSS THE COUNTRY

From a national perspective, there’s no immediate shortage of work heading into 2020.

“The industry is very busy overall,” says Gary Webster, a partner at KPMG, as well as the firm’s national head of Infrastructure for Canada and the global head of Capital Projects Leadership. “If you look at the supply side, there are more projects, it seems, than there is demand side to deliver them these days.”

“There is so much out there that contractors are taking informed choices,” he adds, noting that some large public jobs are down to a single bidder, or even no bidders at all, as contractors pick and choose what they want to work on.

Construction on an elevated guideway for the new Réseau express métropolitain in Montreal PHOTO: REM

Gerard McCabe, managing director for Turner & Townsend Canada, is similarly bullish for the industry in 2020.

“We’re certainly not growing at the rates overall that we were a few years ago, but it feels positive,” he says. With the federal election now in the rear view and a strong minority entrenched in Ottawa, McCabe anticipates a bit more stability in the coming months. “I think it’s fairly safe to say that it feels like for the next year or two, that government will stay and the provinces are fairly well settled.”

Further investments in infrastructure could also help mend fences between certain segments of the country following the election, says Mary Van Buren, president of the Canadian Construction Association.

“With the polarization that we’re seeing politically [and] regionally, infrastructure is such a great uniter,” she says, adding that a significant portion of Canada’s existing infrastructure still needs work. Van Buren pointed to the 2019 Canadian Infrastructure Report Card, which found that about 40 per cent of Canada’s roads and bridges are in fair, poor or very poor condition.

Though prospects are generally good for builders next year, where you look in the country is a factor. Toronto’s skyline, for instance, is dotted with more cranes than any other city in North America. The same can’t be said of the Prairies, where next year’s outlook is less optimistic.

Paul De Jong, president of the Progressive Contractors Association of Canada, is more cautious in his forecast for the industry in 2020.

“I think there’s a lot of headwinds that we’re facing still,” he says. “Until we have more clear and committed political leadership and the ability to demonstrate to investors that we are a fit and a vibrant industry that is worth the investment, I think the construction industry is going to be facing the wind.”

Construction in northern Manitoba on the Keeyask dam. The project is nearly finished with 2019 as the final year of peak construction. PHOTO: Manitoba Hydro

De Jong points to the passing of bills C-48 and C-69 earlier this year, which placed a moratorium on oil tankers on B.C.’s northern coast and overhauled the country’s environmental review process, as major obstacles for construction as a whole. He acknowledges the industry covers a far wider scope than just the energy sector, but feels the effects will trickle down across the country. “If [the energy] industry is constrained, I have grave concerns about the level of economic activity in general in Canada,” he says. “You see fewer dollars going into provincial and federal coffers… and you see corporate and institutional investors looking at Canada with a doubtful eye and wondering if it’s really a healthy place to do business.”

Having taken the temperature of countless contractors over the last few months, Douglas Correa, executive vice-president of Global Specialties and national leader of the Construction Services Group at Aon Canada Inc. is cautious in his outlook for 2020 as well, particularly when it comes to smaller contractors that don’t play in larger arenas, such as the P3 market.

“I’m not hearing a lot of the sky is falling, but I’m hearing a lot of pessimism rather than optimism,” he says, adding that after years of strong economic growth, contractors are viewing 2020 with more trepidation than they have any other year in the past five.

REGIONAL OUTLOOK

BRITISH COLUMBIA

There are few causes for concern on Canada’s West Coast.

Between LNG work, pipelines and big civil projects such as the new Pattullo Bridge and the Broadway Subway Project in Vancouver, “B.C. will continue to be busy,” Webster says. “There are some new projects that could hit the street as well.”

Construction on the Site C project in northeastern B.C. is also scheduled to continue well into next decade. Work on the substantial earthworks required to support the $10.7 billion dam on the Peace River are already well underway.

The real estate market in the Vancouver area and the strong demand for multi-unit residential is another driver.

In its most recent Provincial Outlook, released in mid-October, Scotiabank forecast B.C.’s real GDP to advance 2.8 per cent next year.

ALBERTA

After several years in the doldrums, Alberta’s economy is forecast to finish 2019 little changed, but is poised to perform better next year. In a recent research note, RBC Economics says it expects the province’s real GDP to grow 1.9 per cent in 2020.

Likewise, Bill Ferreira, executive director of construction research organization BuildForce Canada, expects greater consistency for the province’s labour force. “Alberta does seem to be through the worst,”he says. “We are now hitting a period of greater stability.”

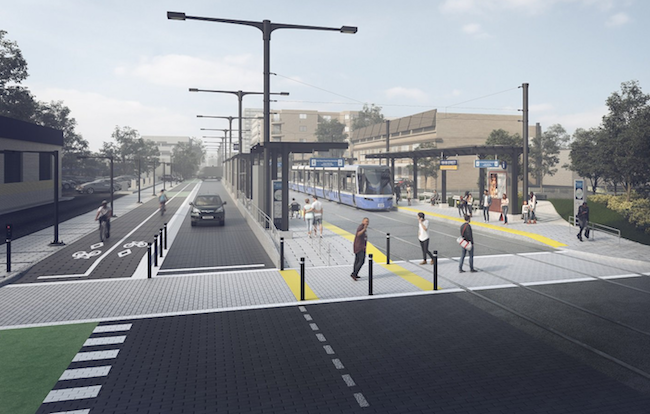

A rendering of the new Valley Line West in Edmonton. Provincial cutbacks have put the project on uncertain ground. PHOTO: City of Edmonton

That doesn’t mean there aren’t challenges. Coming off a slowdown, the province’s construction market is already running at lower capacity than those in other provinces. Recent developments — most notably the provincial government reining in spending on light rail lines in Calgary and Edmonton — could also force the two cities to slow down these public transit projects considerably.

“With the austerity measure that the government of Alberta has taken, they’re going to be reducing investment in infrastructure or at least delaying investment in infrastructure,” McCabe says. “So, that is not going to help what is already a fairly difficult construction market.”

McCabe does not anticipate Alberta will climb out of its slow construction period until pipeline projects can get off the ground and oil prices begin to inch back up.

SASKATCHEWAN

With crews completing the $1.9 billion Regina Bypass this fall and low levels of investment expected to continue in the oil and gas and resource sectors, Saskatchewan builders are likely looking at a limited number of major projects in 2020.

Insiders expect the building market to remain steady, though this translates to little change in what’s already a down market. “In Saskatchewan we’re not seeing much of anything happening,” Ferreira says. “It’s fairly consistent with last year’s forecast, unfortunately.”

In its most recent annual report, BuildForce noted Saskatchewan has lost more than 7,000 construction jobs since the resource sector peaked in 2014.

The residential segment of the market will offer little help. The Conference Board of Canada expects housing starts to be under 1,400 next year, just above the post-recession high of 1,200 projected for 2019.

MANITOBA

Construction reaching completion, or beginning to wind down, on several long-running projects, most notably the Keeyask Generating Station in the northern part of the province and a segment of Enbridge’s Line 3 pipeline, will take their toll on Manitoba’s building market in 2020.

In a research note this fall, TD Economics said it expected to see non-residential investment decline next year with major project work slowing. Overall, the bank forecast real GDP growth of 1.7 per cent next year.

De Jong, likewise, sees some construction activity continuing across the province, but few new major sources of work.

Construction ramping up on the approximately 200-kilometre Manitoba-Minnesota Transmission Project, worth $453 million, is one exception that will provide some positive momentum.

ONTARIO

A construction market already running close to full steam and a substantial load of new work for 2020 and beyond mean Canada’s most populous province will remain very busy.

A tunnel for the new Eglinton Crosstown LRT in Toronto, which is currently under construction. PHOTO: Metrolinx

“The real estate market just continues to defy all odds… in the Greater Toronto Area, but the activity across the province of Ontario is very high in all regions,” Ferreira says. “There’s been a slight uptick in mining interest in the north, the southwest remains very busy with a number of major projects both projects in Sarnia, the bridge in Windsor [and] a new food processing facility in London.”

In Toronto, the slate of building projects remain diverse. Work on the Eglinton Crosstown LRT is progressing above and below ground, while new large-scale residential, commercial and institutional projects continually add to company backlogs. If the province-led initiative to build four new or expanded transit lines worth about $30 billion moves forward, it will keep infrastructure construction crews busy for at least another decade.

Strength in the Ottawa market is expected to continue as well, between residential, transportation infrastructure and government rehabilitation work. McCabe pointed to the overhaul of Centre Block on Parliament Hill — that’s been described as the “largest, most complex heritage rehabilitation” ever undertaken in Canada — as one prominent example.

Few insiders have any concern for the Ontario construction market, with the exception of uncertainty about where contractors will find the labour force to take on new projects.

In a November research note, RBC said it anticipates the province’s real GDP growing by 1.5 per cent in 2020.

QUEBEC

The outlook in Quebec is positive, with Montreal leading the way.

Webster singled out work on the city’s port, airport and transit infrastructure as key areas to watch. Construction on the Réseau express métropolitain, or REM, is already underway and early prep work for the extension of the Metro’s blue line could start as early as next spring.

As in the country’s other urban centres, the tight Montreal real estate market and increasing need for density is also driving residential development activity.

Outside Montreal, construction is expected to remain steady.

Strong real GDP growth in Quebec has outpaced much of the rest of the country in recent years. Though its pace of economic expansion is expected to slow slightly in 2020, Scotiabank still anticipates the province to record 1.6 per cent growth.

ATLANTIC CANADA

There’s not a “big boom” of new projects coming to Atlantic Canada in 2020, all parties view the East Coast market as relatively steady.

Some provinces are forecast to do better than others.

In Newfoundland and Labrador, major projects, such as the Muskrat Falls dam that brought an influx of workers to the province, are expected to begin winding down after years of work. “Newfoundland and Labrador is coming off an exceptional period of investment that required an increase to its non-residential labour force,” Ferreira says. “We’re now readjusting back to a more normal level of activity.”

With few drivers, experts expect similarly slow forward momentum in New Brunswick.

Stronger growth is forecast for Nova Scotia, and for Halifax in particular. With a growing population and real GDP growth of 2.1 per cent expected for the city in 2020, according to the Conference Board of Canada, builders will be kept busy on residential work.

Several health care projects are also moving through procurement in Nova Scotia and an investment decision on the multibillion-dollar Goldboro LNG project is expected next year.

Though it remains a small market, population growth in P.E.I. continues to fuel new infrastructure projects and the construction market. The province plans to spend about $156 million on infrastructure in 2020.

A SHAKY FOUNDATION

Certain pockets of the country are busier than others, but overall, the relatively healthy economy and long list of major new projects scheduled to get underway in 2020 and beyond mean securing work is unlikely to be the construction industry’s biggest challenge.

When it comes to finding and retaining workers, the industry is on looser ground.

If stockpiles of key materials, such as steel or concrete, begin to run low, suppliers can typically increase production capacity to meet demand. The supply of labour, McCabe notes, is far more temperamental. “The level of skilled resources is decreasing over time and it doesn’t seem to me as if we’re doing enough about it,” he says. “We’re just waiting for something to change, but we’re not actually doing anything to make the change.”

The issue is well documented and while industry advocates are undeniably focussing on addressing it, the impending wave of retirements is daunting. In its most recent assessment, BuildForce, which publishes nationwide figures on the topic annually, expects the industry will need to attract about 80,000 more workers over the next decade than it currently expects to. A new batch of data will be available in early 2020.

A worker at the Centre Block project in Ottawa. Skilled labour is again one of the major concerns for contractors in the year ahead. PHOTO: Public Services and Procurement Canada

Along with the sheer numbers, the breadth of the shortage raises alarm bells. “It’s at all levels of the demand side,” Webster says. “From management, down though the trades to the labourers, there’s a shortage.” Without an adequate workforce at its foundation, the industry won’t be able to deliver on the significant pipeline of new projects.

Solving the problem will require new innovations and a willingness to adopt new ways of thinking.

“Five to 10 years in the future, if we adopt technology correctly, there’ll be many more construction sites,” Webster says. “There probably aren’t many more people employed in the industry, but those people that are will be on more construction sites because productivity increases will allow more to be built.”

THE RISE OF TECH

Just under 10 years ago, the first iPad hit the market. Today, it’s tough to find a construction site without one. For an industry notoriously behind the times, the transformation has been a bolt from the blue.

Following this example, experts see Canadian builders embracing tools such as building information modeling (BIM), drones, automated equipment and machine learning, with increasing frequency in the year ahead. Most expect novel equipment and software systems to boost worker productivity and help the industry mitigate some of the worst effects of the labour crisis.

“We’re seeing that dialogue shift in the perception of technology and the need for construction project management technology,” says Jas Saraw, vice-president, Canada for Procore. “It’s almost like it’s become table stakes for the industry. We’ve got this massive amount of data that we have to consume and we’ve got a level of complexity that’s increasing daily on the types of jobs that contractors are running.”

Among other benefits, software capable of making use of job site data can save valuable time, often letting existing crew refocus on tasks machines can’t do. “Technology is an enabler, whether that’s augmenting processes, helping people become more productive, or that’s investing in technology that can automate where workers just aren’t available,” Van Buren says.

While workers in other industries — manufacturing being one prominent example — have seen their productivity nearly double since the 1990s, global construction productivity has barely budged, according to McKinsey & Co. Insiders see this trend beginning to change as technology companies purpose-build more solutions for construction.

A launching gantry being used for construction of the REM in Montreal. It’s the first time the technology has been deployed in the province. PHOTO: REM

“There’s been a big shift over the past five years for the construction industry to find technology,” Correa says, “and suppliers with the industry are bringing technology solutions to projects.”

The lively construction tech start-up scene in both Canada and around the world is a case in point. With high levels of venture capital funding available to innovative new companies, contractors are getting custom tools and services that solve long-nagging issues.

So far, adoption remains inconsistent, with some contractors aggressively investing in new job site tech and others content to pull in just the tools that have proven themselves invaluable. Before long, however, Webster anticipates those shifting too slowly will be left behind. “If our contractors don’t adopt it now, there’ll be new players that come in. We’re seeing technology companies experiment in construction techniques right now,” he says, adding that tech firms aren’t necessarily looking to become builders, but are innovating more quickly. “They will take over the construction sites of the future if we don’t smarten ourselves up.”

Tech is guaranteed to play an ever-increasing role in construction, but it’s doubtful it offers a complete answer to the labour crunch.

“I think we could use technology far better than we are using it right now,” McCabe says, “but at the end of the day, we need skilled trades, we need skilled engineers, management staff, all the way through the hierarchy of how we deliver projects.”

LEVELS OF SOPHISTICATION

The need for change goes well beyond the job site itself.

“We’re not that sophisticated,” McCabe says. “The industry needs to evolve beyond where it is right now and do business in a different way — whether it’s using technology, whether it’s changes in how we procure construction work… to how we negotiate construction contracts.”

The diverse list of challenges require a diverse set of solutions, but all revolve around bringing a higher level of sophistication to construction processes.

The low-cost bid framework that still dominates much of the public sector, for instance, certainly limits job site experimentation. It may also be holding the industry back.

“What we’d like to see is more piloting [and] a little bit more room for including innovation within the project itself,” Van Buren says. “Whether that’s trying out new materials, whether that’s investing in technology, whether that’s new processes that can be tried, or new ways of working together.”

New developments in technology and procurement mean how the industry has delivered projects in the past may not carry over to the future

Van Buren says the CCA would like to see the Infrastructure Bank step in and play a role in this arena, helping to de-risk projects that test new methods.

Other countries have already started moving away from the low-cost bid environment in favour of more nuanced approaches. Webster points to New Zealand as one example. This fall, the country introduced a so-called “broader outcomes” framework that takes more into account than just a low cost to the public purse.

In conjunction with this price point shift, increasingly, stakeholders throughout the construction pyramid are abandoning traditional top-down project models for a more collaborative approach.

“The traditional way is owners will police contracts and so that automatically creates an adversarial relationship in the delivery,” Webster says.

“Contractors don’t know the challenges that owners go through to get projects approved… Conversely, owners don’t really understand the challenges of the contractors,” he adds. “When you get this collaborative contract that they’re working together to those ends, all of a sudden, you’re seeing a different view, you’re able to solve problems better.”

Integrated project delivery (IPD) and early contractor involvement (ECI) are just two examples of new strategies being used to deliver jobs. Insiders expect the appetite for these alternative procurement models will only increase in 2020 and beyond.

In Ontario, for instance, provincial agencies Infrastructure Ontario and Metrolinx recently awarded the Canadian sector’s first Alliance contract for an upcoming expansion of Toronto’s Union Station.

At the annual conference of the Canadian Council for Public-Private Partnerships this November, Phil Verster, president and CEO of Metrolinx, said all segments of the industry need to do a better job working in partnership with one another. “That requires that we have a contracting structure that is more incentivizing rather than penalizing,” he said. “You can get performance by having a big stick, or you can get performance by having value that is shared and gains that are shared.”

Slowly, these sort of approaches are taking root. Often they’re helping to address other long-nagging issues, such as the burden of risk.

“Projects are seeing more and more risks added to them and I would say stakeholders within projects are looking for ways to mitigate risk,” Correa says, adding that all levels of the industry are experimenting with a range of tools that adjust how jobs are delivered. “The essence of it is, much more collaboration on the front of the projects, so the surprises don’t occur procuring and on the back end.”

This article originally appeared in the December 2019 issue of On-Site. Click here to read through the whole issue.