The tariffs have been lifted, but construction cost inflation still looms large

By Gerard McCabe

Construction

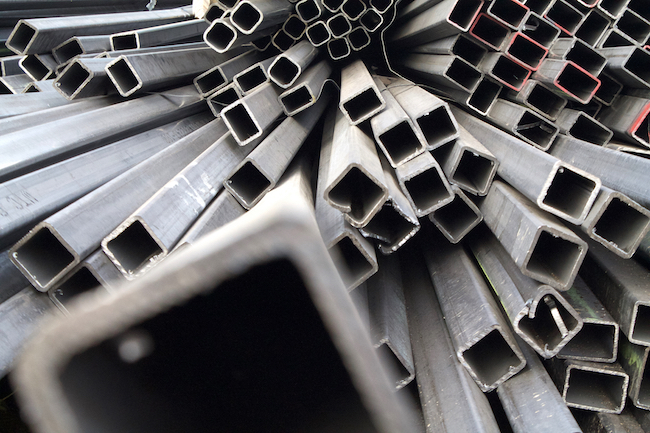

Construction costs climbed considerably because of steel and aluminum tariffs. They were lifted in May, but that doesn’t mean prices simply returned to normal

The lifting of tariffs may have been a huge weight off the shoulders of the Canadian construction market, but it remains under considerable strain. This is due to the strength of booming demand combined with months of uncertainty surrounding the renegotiation of the North American Free Trade Agreement. A new trade deal appears to be headed toward ratification, but strong demand continues to contribute to spiralling construction costs.

Donald Trump’s import tariffs on steel and aluminum added large capital costs to construction projects in Canada. As the biggest international buyer of American steel, the effects of the 25 per cent tariffs in particular were felt enormously. Our data shows the tariffs added an estimated four to eight per cent to the cost of constructing a 25-storey office tower or industrial warehouse.

The lifting of these tariffs by the US government in May was a welcome development to the construction sector and the move has been well received, but it did not reverse the impact overnight. The implications are still being felt across the industry and there is no evidence yet to show this has translated to falling input prices — and we do not expect to see the benefits feeding through the supply chain for many more months to come.

More certainty has been brought to the market, but a lack of clarity persists surrounding the uplift in supply and capacity that is required to meet the increasing levels of demand currently being experienced in certain areas of the Canadian market. It is this supply-demand imbalance that continues to drive pricing and fuel further escalation in construction costs.

Our International Construction Market Survey 2019 revealed Vancouver to be the 14th most expensive place to build globally, with the average cost of construction now CAD$3,510 per square metre . This means that for every building constructed in the city, you could build three similar structures for the equivalent cost in Beijing.

Key residential and urban centres are seeing the strongest development demand, and the construction markets in Toronto, Vancouver and Ottawa are all classified as ‘hot.’ This contrasts with New York, previously the most expensive place to build in the world, which is now rated just ‘warm.’

In these Canadian cities, the shortage of skilled labour — especially in masonry, finishing trades and mechanical and electrical trades — is pushing up wages and adding significant costs to projects. Turner & Townsend’s own analysis showed Vancouver is experiencing the highest labour costs of any Canadian market, at $63.70 per hour, closely followed by Toronto at $62.70.

Coupled with a slowing global economy, the Canadian construction market is faced with instability, shortage of trade labour, climbing costs and squeezed margins.

Even without the spectre of import tariffs, the challenge remains for clients and contractors to mitigate and manage cost inflation effectively, ensuring a steady pipeline of investment.

This means adopting the right procurement and supply chain management models from the outset. Clients should also continue to carry contingency to the cost of building core and shell especially for steel framed structures to account for the legacy impact of the import tariffs. They may have ended, but supplier costs have not yet been reduced to reflect this.

In the long-term, investment in labour-saving technologies and innovative delivery models will help to combat the shortage of skilled labour and build the capacity the industry needs. This must include embracing new methods of construction, such as modular and the more prevalent use of offsite manufacturing to produce standardized building components at scale in quality-controlled environments. Not only will a shift in construction mindset drive productivity, but it is critical to changing the perception of careers in the industry and attracting the next generation of talent we need.

The end of the trade war tariffs delivered a confidence boost for the Canadian construction industry, but it is far from the end of the story. The ongoing market recalibration on material costs, severe labor shortages and storming pace of demand will categorize the next chapter. It is vital that we come together to embrace new technology and attract new skills ready to create an industry fit for the future, and able to weather the ongoing uncertainty.

Based in Toronto, Gerard McCabe is the Managing Director of the Turner & Townsend’s Canadian operations and is responsible for the overall management of the Canadian Business. He graduated from the University of Ulster (Belfast, Ireland) with a Bachelor of Science degree in Quantity Surveying and has practiced in Canada since 1987. Gerard was a founding partner of cm2r and led the merger of cm2r with Turner & Townsend in 2010. With over 30 years of experience specializing in Cost and Project Management, Gerard has extensive experience in a number of construction industry sectors including healthcare, education, performing arts, residential, infrastructure, and both provincial and federal government.