Housing starts hit with a difficult March

By Adam Freill

Construction ResidentialBright spots like Vancouver’s spike in multi-unit starts not enough to offset losses elsewhere as the SAAR of total housing starts drops by 11%.

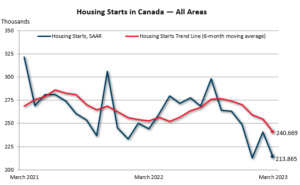

February’s gains were more than wiped out as the standalone monthly seasonally adjusted annual rate (SAAR) of total housing starts for all areas in Canada declined 11 per cent in March. According to data compiled by Canada Mortgage and Housing Corporation (CMHC), SAAR came in at 213,865 units last month, down from 240,927 in February, and below the 216,514 units reported in January.

Single-detached urban starts, a look at centres with populations of 10,000 and higher, were hit particularly hard, falling 16 per cent. Conversely, multi-unit urban starts increased 11 per cent to 151,769 units.

Among the Vancouver, Toronto, and Montreal CMAs, only Vancouver recorded an increase in total SAAR housing starts in March. That city saw a 98 per cent jump as it posted more than twice as many multi-unit starts compared to February. Montreal dropped 12 per cent and Toronto declined 26 per cent.

The trend in housing starts sat at 240,669 units in March, down six per cent from February. The trend measure is a six-month moving average of the monthly SAAR of total housing starts for all areas in Canada.

“Despite the national decline in March, the SAAR of housing starts and the trend appear to be returning to pre-pandemic levels,” said Bob Dugan, CMHC’s chief economist. “With interest rates remaining high, it continues to be challenging for developers and homebuilders to get projects started. We will need to find innovative ways to deliver more housing supply to keep up with demand and ultimately improve affordability.”

Those interest rates had a visible impact on the residential construction sector in 2022, added CMHC in its latest Housing Supply Report, which examines new housing construction trends in Canada’s six largest CMAs.

Growth in residential construction was mixed across those cities in 2022, as housing starts increased in Toronto, Calgary, Edmonton and Ottawa, remained unchanged in Vancouver, and decreased in Montreal.

Starts in Toronto rose by almost eight per cent in 2022, reaching their highest level since 2012 as higher condominium apartment construction from strong presales over the past two years impacted the numbers. In contrast, total starts declined more than 25 per cent in Montreal, returning to recent average levels following record starts in 2021.

In Edmonton, new purpose-built rental apartment construction increased significantly in 2022. The increase was spurred by projects concentrated near the downtown core and in newly developing neighbourhoods on the periphery. Calgary also benefited from construction of purpose-built rental as that city saw more starts of those units, and of condominium apartments, increase significantly in 2022, with projects concentrated near the downtown core and in newly developing neighbourhoods.

Densification also continued in Ottawa’s residential construction market in 2022. Last year was the first time in more than 20 years that the share of apartment starts accounted for more than half of total housing starts in the region.

While there were more cities with gains than losses in the report, CMHC says significant increases in interest rates influenced the activities of both developers and homebuyers as 2022 progressed, adding that the full impact of the increase in interest rates is not yet reflected in the CMHC Housing Starts and Completions Survey, which measures the pace of construction of new residential housing in Canada.

“In some centres, seasonally adjusted housing starts began moving lower at the end of 2022 and early 2023,” said Francis Cortellino, senior specialist for housing market analysis at CMHC. “The higher interest rate environment will likely slow construction activity in more centres in 2023.”

“Some projects may become unviable at current financing rates, or construction financing will become harder to obtain,” added Eric Bond, senior specialist for housing market analysis at CMHC.

This slowing is not helping with inventories of new and unabsorbed homeownership units – housing units that have been completed but not yet sold – which are currently at historic lows. Because of the resulting limited options on the market, CMHC advises that households in large CMAs may find it harder to access housing that meets their needs.