Growth in non-residential capital spending to continue in 2023

By Adam Freill

Construction InfrastructureStatistics Canada predictions for 2023 spending indicate smaller gains as growth continues, but at a slower pace.

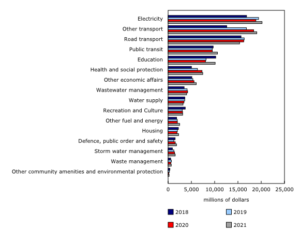

Capital expenditures, infrastructure assets, by function.

(Source: Statistics Canada, Table 34-10-0280-01)

Businesses and governments are expected to invest $319.9 billion in non-residential construction and machinery and equipment in 2023, says Statistics Canada. That anticipated level of spending is 4.3 per cent higher than the preliminary 2022 results and follows two years of double-digit annual growth. Last year showed growth of almost 12 per cent, while a 10 per cent rise was posted in 2021.

Although the public sector accounted for over half of the $32.1 billion increase in 2022, Canada’s statistical agency expects the private sector to be the main source of growth in 2023, anticipating a 5.2 per cent private sector increase to go along with a slowing of public sector growth to around 2.7 per cent in 2023.

Revised 2021 non-residential capital and repair expenditure figures indicate that capital investment in infrastructure assets rose by $5.7 billion in 2021 to $108.1 billion. Growth was observed in 13 of 16 infrastructure functions, although decreases of roughly five to six per cent were observed in road transport, wastewater management and water supply.

The mining, quarrying, and oil and gas extraction sector is expected to regain its top spot for capital spending in 2023, as expenditure intentions increased by 13.7 per cent to $52.9 billion. Capital expenditures on non-residential construction and machinery and equipment in the oil and gas extraction subsector are expected to reach $35.1 billion in 2023, slightly above the $33.9 billion registered in 2019, before the COVID-19 pandemic.

After declining slightly in 2022, capital outlays in the manufacturing sector are expected to increase by 12.6 per cent in 2023, to reach $27.2 billion. Major project announcements for 2023 include a $737 million investment to decarbonize Rio Tinto Fer et Titane’s operations in Quebec and Imperial Oil’s $720 million new renewable diesel facility in Alberta.

Major project announcements in the transportation equipment manufacturing subsector include a $3.6 billion investment by Stellantis for multi-energy vehicle assembly facilities at its Windsor and Brampton plants in Ontario. In addition, Stellantis and LG Energy Solution announced plans for a $5 billion large-scale lithium-ion battery production plant in Windsor, while General Motors and POSCO Chemical announced plans for a $500 million cathode active materials plant in Becancour, Quebec.

In Atlantic Canada, construction activities are expected to increase as rebuilding efforts continue following Hurricane Fiona, which caused considerable damage in September, however, some projects may face delays, considering the increasing cost of construction, as well as labour shortages.