End of an era: 20 years of ‘almost uninterrupted’ construction growth poised to slow

By David Kennedy

Construction Financing Infrastructure LabourConstruction activity is expected to inch forward at a slower pace over the next decade as certain provinces ramp up work and others tap the brakes, BuildForce Canada says

Work in the non-residential segment of the industry is expected to pick up some of the residential market’s slack over the next five years

OTTAWA—For nearly two decades there have been few reasons, or free moments, for the Canadian construction industry to take a breath. But the inertia of strong demand that’s driven the industry forward, particularly since the 2008 downturn, is now losing momentum, according to the latest industry forecast from BuildForce Canada.

The research organization said it expects the construction labour force and industry building activity to plateau following 2020 as residential building slows. Work in the non-residential segment, particularly on new infrastructure and energy projects, will pick up some of the slack, ensuring overall building activity remains strong, but not enough to sustain the growth levels the market has enjoyed over much of the past 20 years.

“Following about two decades of almost uninterrupted expansion during which the construction labour force doubled, Canada’s construction sector has entered a new period of slower growth,” the report says.

Related: The impending shortage: Canadian construction industry has 300,000 jobs to fill over next decade

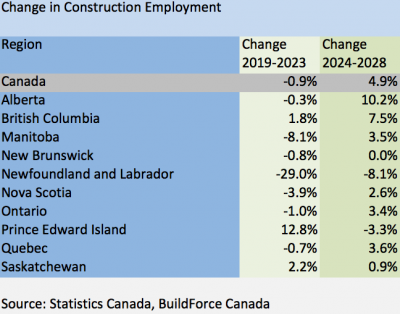

BuildForce, which primarily tracks the construction labour market, predicts a five-year slowdown in residential building between 2019 and 2023, before population growth is able to reignite the segment. Non-residential building, bucks this trend in certain provinces, but faces challenges in others.

PROVINCE TO PROVINCE

BRITISH COLUMBIA

In B.C., where 1.8 per cent workforce growth is predicted over the next five years, BuildForce points to ongoing work at the Site C hydro project, as well as upcoming construction on the long-troubled Trans Mountain Pipeline expansion and new $40 billion LNG Canada export terminal as some of the province’s main drivers.

It also notes infrastructure work, such as public transit projects, the expansion of the Vancouver International Airport and the Pattullo bridge replacement project as growth drivers. Between 2024 and 2028, BuildForce anticipates B.C.’s construction labour force will increase by 7.5 per cent.

ONTARIO

Multiple light rail transit projects and two nuclear power plant refurbishments are expected to keep Ontario churning over the next 10 years, BuildForce’s executive director Bill Ferreira, said. “Ontario also continues to grapple with record levels of construction project activity and recruiting challenges. However, labour demands are projected to plateau or recede in most other provinces.” Despite the continued activity, the forecast shows the province’s workforce declining by one per cent between 2019 and 2023 before jumping by 3.4 per cent the following five years.

NEWFOUNDLAND AND LABRADOR

On the opposite side of the spectrum, the industry-led research organization predicts significant trouble for construction in Newfoundland and Labrador. Labour demands will drop 29 per cent over the next five years and another 8.1 per cent between 2024 and 2028. The wind down at the Muskrat Falls construction site is one of the of the main causes of the expected decline. BuildForce added that it will take the emergence of several new big ticket projects to avoid the slowdown.

THE MARITIMES

Elsewhere in Atlantic Canada, the situation is more positive. The New Brunswick labour market is expected to remain essentially flat over the next decade. Similarly, Nova Scotia will see little change from 2019 to 2028, but spending trends point to a loss of 3.9 per cent of jobs over the next five years before a recovery and a 2.6 per cent expansion from 2024 on. Prince Edward Island, meanwhile, is getting set for its “busiest construction season ever” in 2019, BuildForce says. The small province is expected to add 12.8 per cent to its construction workforce between 2019 and 2023, but will then fall back to Earth, shedding 3.3 per cent of positions over the following five years.

QUEBEC

More balance is forecast for Quebec, where both public and private building is expected. Montreal’s Réseau express métropolitain, a transit systems partially funded by the private sector, is among the most prominent projects now underway in the province, but investments in other more conventional public infrastructure such as roads, hospitals and schools are also expected to keep workers across the province busy. Quebec’s construction workforce is poised to decline 0.7 per cent through 2023 before returning to steady growth and adding 3.6 per cent between 2024 and 2028.

MANITOBA

In Manitoba, the end of one major infrastructure project will make way for another. As work on the Keeyask hydroelectric dam nears completion, construction on a flood channel between Lake Manitoba and Lake St. Martin flood channel will absorb some of the workforce. Enbridge’s Line 3 pipeline replacement will also help make up for some of the losses following the Keeyask project, though not all of them, BuildForce says. The province will see its construction workforce decline 8.1 per cent in the next five years before recovering 3.5 per cent in the latter five.

SASKATCHEWAN

Next door, the slowdown in resource expansion will also decelerate construction in Saskatchewan, though the construction workforce in the province is expected to grow in both halves of the 10-year period. The report credits new mining and utility projects forecast to begin after 2020 for anticipated growth of 2.2 per cent between 2019 and 2023. 0.9 per cent growth is expected the following five years.

ALBERTA

As is the case is in many Canadian regions, Alberta also faces a modest construction labour decline over the next five years. The province’s workforce will slide 0.3 per cent between 2019 and 2023, but will recover to the tune of 10.2 per cent between 2024 and 2028. BuildForce pointed to the province’s push to diversify its economy — and the industrial and institutional building construction that will come with that drive — for the relatively flat five-year outlook. Over the longer terms, the research organization says industrial and commercial building construction, plus renewed oilsands activity, will fuel construction across the province.